Strassel then said Firoina, like Thatcher, is a politician who happens to be a woman, rather than a female politician standing on women’s votes.

Speaking presumably partly from personal experience, Strassel added:

Fiorina knows [what] she has to do: her homework. . . She knows she can’t slip up. Her Wednesday performance—from her mastery of facts, to her fluid delivery, to her zingers—was clearly the work of hours upon hours of study and debate prep.The implicit message of Strassel’s piece: “Democrats, watch out!”

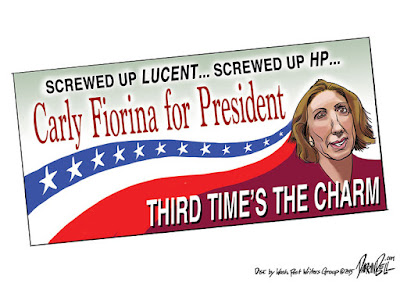

Wouldn’t you know the Democrats’ allies in the media were alert to just such a development? The same morning conservatives were cheering Fiorina as the GOP’s answer to Britain’s “Iron Lady,” Chris Cillizza, in the liberal Washington Post, was warning Republicans, “This is the ad that could kill Carly Fiorina’s campaign.” Run by Senator Barbara Boxer (D-CA) against Fiorina in Boxer’s victorious 2010 California Senate campaign, Cillizza reported that

The commercial notes that Fiorina laid off 30,000 workers at HP [Hewlett-Packard] while feathering her own nest (the ad's narrator says she tripled her salary) and buying a "million-dollar yacht" and "five corporate jets."It took the New York Times’ Amy Chozick and Quentin Hardy another three days to rev up that paper’s assault on Fiorina’s record. Under the biased headline “As Profile Rises, Carly Fiorina Aims to Redefine Record as a C.E.O”--of course “redefine” means “fixing” something wrong--Chozick and Hardy on Page One wrote that Fiorina and supporters are trying to alter Fiorina’s

rocky business reputation and fend off attacks on her as an unfit and heartless executive. Such accusations helped doom her 2010 Senate campaign in California. Democrats called her “Carly Fail-orina,”The New York Times suggests--and implicitly hopes--Fiorina

risks becoming bogged down in a defense of her record at the expense of her message as a political outsider who would bring conservative change to WashingtonAttemptiong to keep her on the defensive, the article attacks Fiorina’s “knack for self-elevation,” pointing out that “Carly is not an engineer,” and rips into HP’s $24.2 billion merger with Compaq Computer, which “divided the HP board” and greatly increased the company’s size.

Quite gratuitously, Chozick and Hardy add:

The deal was so personal to Fiorina that she referred to HP as “Héloïse” and Compaq as “Abélard,” a pair whose romantic letters became treasures of medieval French literature, which she studied at Stanford. (Abélard was eventually castrated after fights with Héloïse’s family, a detail Compaq executives were unaware of at the time.)Good grief. “All the news,” fit or unfit to print.

Chozick and Hardy won’t allow Fiorina to blame the fall of HP’s stock price on the well-known burst of the dot-com bubble that drove many tech firms out of business, as they tell us “HP shares fell by more than the stocks of competitors like Dell, IBM, Intel and Microsoft.”

This kind of reporting is called “cherry-picking.” The two Timespersons, echoing the Boxer ad, inform us that Fiorina

ushered in a period of corporate scandal, including public clashes with members of the Hewlett family. Fired in 2005, she left with more than $42 million in severance, stock options and pension.Board fights and golden parachutes a “scandal”? Really?

Ranging far afield in their search for dirt, Chozick and Hardy proclaim that HP is cutting up to 30,000 jobs today. That’s a full decade after Fiorina left the firm, but an action “which Fiorina’s detractors view as a repudiation of her legacy."

According to Chozick and Hardy, “some”

say the latest saga began with Fiorina’s grand acquisitions, which never yielded the profits or economies of scale she and her successors anticipated. “She had a very mixed tenure,” said George Colony, the chief executive of Forrester, a technology research firm. “The culture she tried to change spit her out, eventually. I’d put her at the top of the bottom third of C.E.O.s.”The Colony quote is significant, since unlike those from others, including Jim Margolis, the ad maker for the Boxer campaign, and Barbara Boxer herself (!), Colony’s bias against Fiorina isn’t obvious on its face.

The piece “Fact check: Carly Fiorina didn't have a great run as CEO of Hewlett-Packard” by Fortune’s Stephen Gandel lacks the New York Times’ raw bias against Fiorina. Fortune (3.6 million circulation, 2014), however, is owned by Time Inc., which leans liberal in contrast to Fortune’s conservative rival Forbes (6.1 million circulation).

Gandel quotes Fiorina saying the tech-heavy NASDAQ stock index fell 80% while she was CEO, sending some HP competitors out of business and eliminating all their jobs. Gandel pointed out that Fiorina pegged NASDAQ’s fall from its peak in early 2000 to its early 2003 bottom. But if you look instead at Fiorina’s full 1999-2005 tenure at HP, the corporation’s stock fell 43% even as the NASDAQ dropped just 23%, and IBM’s shares went down only 29%. Gandel did concede other computer companies went out of business.

Here’s the problem with how Gandel rearranges Fiorina’s “80% NASDAQ fall” numbers. She became CEO in July 1999, just as the NASDAQ began a 91% rise over the next eight months to its all-time high. To measure Fiorina's performance from July 1999 during the NASDAQ bubble’s inflation period instead of from her first major decision as HP chief in May 2000, two months after NASDAQ topped out, makes no sense, except to obscure the fact that Fiorina actually started running HP at the peak of the dot.com bubble, giving her little chance for any positive HP stock performance record. As she correctly points out. The NASDAQ’s fall from its March 4, 2000 peak to Fiorina’s departure was 59%, greater than the 43% HP decline under her tenure.

Even Gandel admits:

Doing some kind of transformative deal was probably the right call for the company, even if Compaq didn’t work out immediately. Eventually, it led to big changes at HP that were for the best. HP has had some good years since Fiorina left the company. Earnings nearly doubled the year after she left, which Fiorina gets no credit for but probably deserves some.Much of the credit for HP success goes to the corporation’s shifting emphasis to printers, a shift that occurred under Fiorina’s tenure. HP's printer and server market share did double from 1999 to 2005.

No comments:

Post a Comment